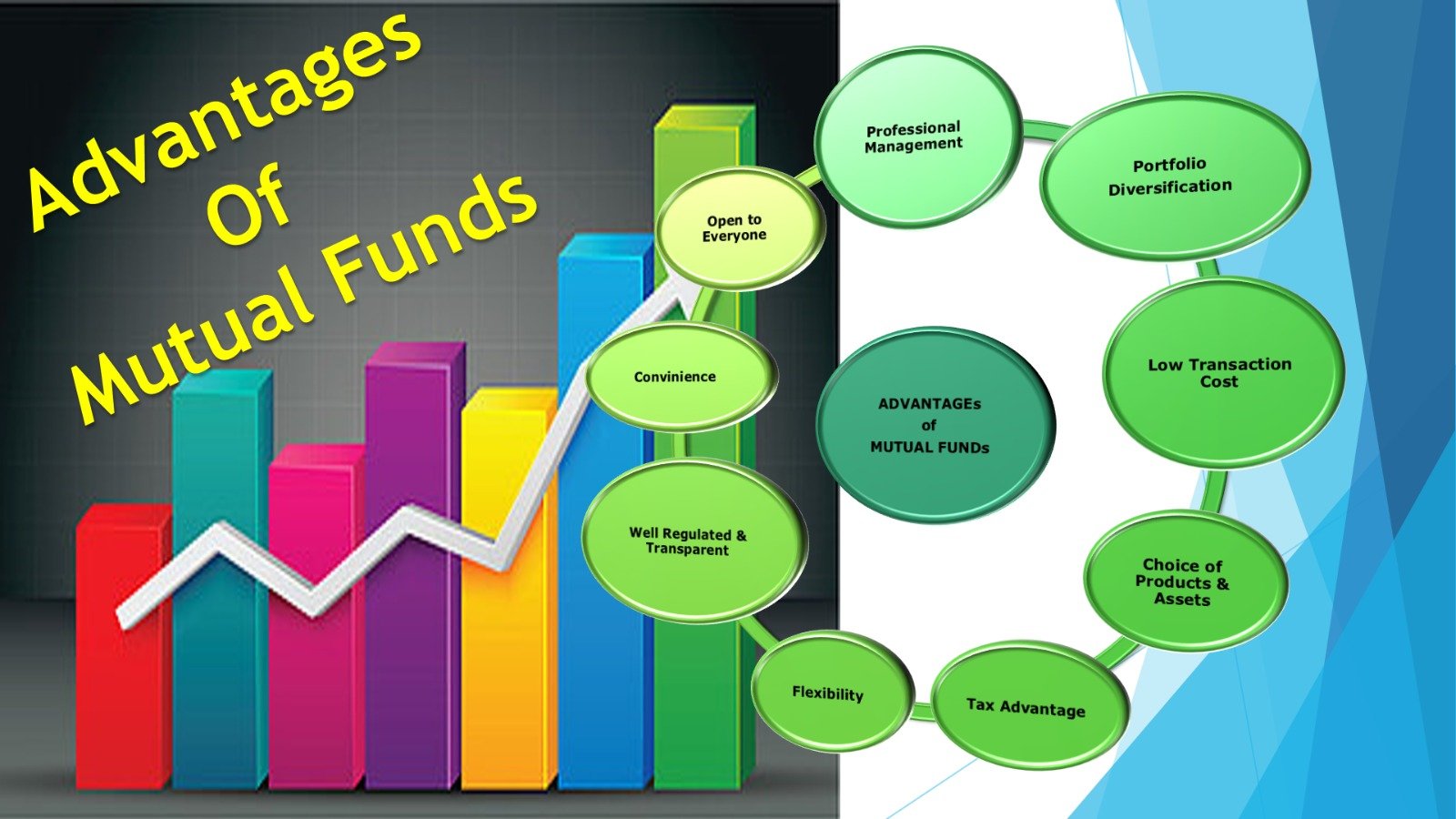

Advantages of Mutual Funds

Professional Management:

Mutual funds hire full-time, high-level investment professionals. Funds can afford to do so as they manage large pools of money. Mutual funds are managed by fund managers generally with knowledge and experience whose time is solely devoted to tracking and updating the portfolio. They have real-time access to crucial market information and are able to execute trades on the largest and most cost-effective scale. Thus investment in a mutual fund not only saves time and effort for the investor but is also likely to produce better results.

Portfolio Diversification:

Diversified investment improves the risk return profile of the portfolio. Optimal diversification has limitations due to low liquidity among small investors. The large corpus of a mutual fund as compared to individual investments makes optimal diversification possible. Due to the pooling of capital, individual investors can derive benefits of diversification.

Low Transaction Costs:

Mutual fund transactions are generally very large. These large volumes attract lower brokerage commissions and other costs as compared to smaller volumes of the transactions that individual investors enter into.

Choice of Products & Assets:

There are four basic types of mutual funds based on the asset class they invest in: equity, bond, hybrid and money market. Further, within each asset class there are further choices of products. For any investment objective of any investor, the choice of the products available are many.

Liquidity:

Liquidating a portfolio is not often easy and you have to rely on the market liquidity for the security. A mutual fund house stands ready to buy and sell its units at any point of time. Thus it is easier to liquidate holdings in a Mutual Fund as compared to direct investment in securities. There are however also products like close-ended funds or intervals funds which have restrictions on the buy and sell transactions.

Tax Benefits:

In India dividend received by investors is tax-free. This enhances the yield on mutual funds marginally as compared to income from other investment options. Also in case of long-term capital gains, the investor benefits from indexation and lower capital gain tax. Investments in the ELSS schemes qualifies under the section 80 C.

Flexibility:

There are many flexibilities available in terms of payment and credit modes, investing, switching and withdrawing from the portfolio like SIP, SWP, STP and Switch with different frequency options. The schemes also offer flexibilities in the nature of plan – with dividend pay-out, reinvestment and growth options. There are virtually no restrictions on the amount, period, product type, plan choices you can make.

Well Regulated & Transparent:

All mutual funds are registered with SEBI and they function within the provisions of strict regulations designed to protect the interest of investors. The SEBI regularly monitors the operations of an AMC. There is high degree of disclosures and transparency also. You get regular information on the value of your investment in addition to disclosure on the specific investments made by the mutual fund scheme. You can also track your investments on a daily basis.

Convenience:

Operationally, there is a lot of convenience and ease in transacting with mutual funds. All your holdings and fund accounting is managed by high quality custodians and registrars. You may make use of auto-debit mandates, ECS, etc. to make & schedule investments. The redemption proceeds, dividends can be automatically credited into your accounts within few days of the transaction. Mutual funds are also available on the stock exchange and you can do transactions through online and other modes in a paper-less manner.