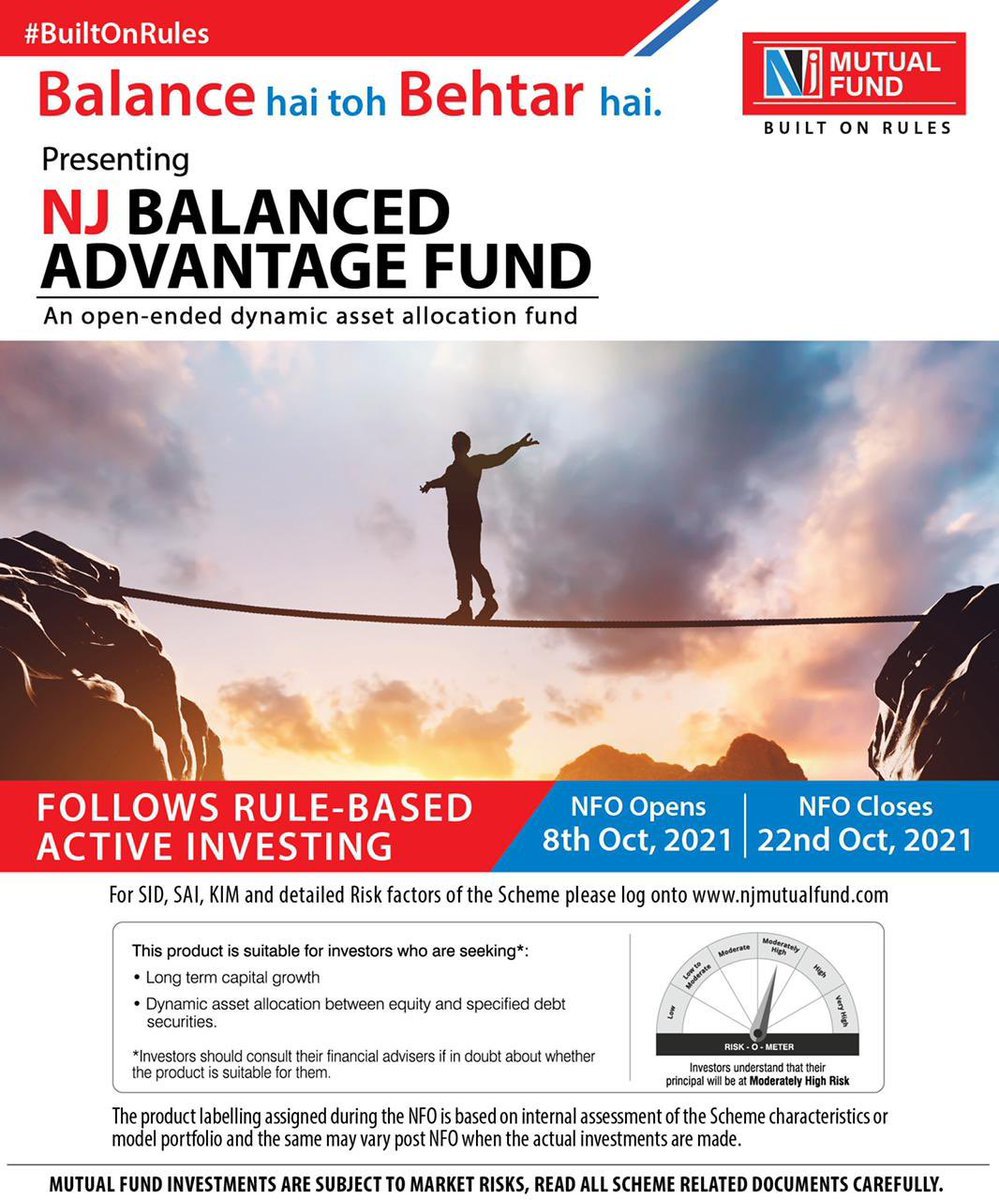

NJ Balanced Advantage Fund NFO review: Should you invest in it?

The scheme

NJ MF wants to launch schemes that are rule-based, also known as smart-beta funds. These Smart-beta funds use a combination of rules to pick investment ideas without a fund manager getting into the picture.

Now, NJ BAF will follow this rules-based approach. BAFs dynamically shift between equity and debt. If the stock market appears to be expensive, the BAF reduces equity exposure and increases the debt component. It follows the exact opposite strategy when markets appear inexpensive.

What works

NJ BAF’s rule-based approach will follow a combination of four factors that have been back-tested over the past 19 years. This exercise is done by the fund house to see how the scheme would have performed with its asset allocation signals and stock selection rules.

“Our aim with this BAF is to reduce equity-linked volatility, while still matching Nifty or close to Nifty returns,” says Rajiv Shastri, chief executive officer of NJ MF.

Other BAFs out there also use certain models that signal if it is the right time to switch the exposures between equity and debt.

NJ’s BAF will use a complex multi-factor strategy to gauge whether markets appear expensive or cheap. Its strategy will not only consider Nifty’s price-to-earnings ratio, but also the worst-case P/E scenario based on historical data. There would also be a comparison with risk-free return (G-Sec yields). The expected earnings growth will be factored in, too.

Depending on the signal shown by these rules, the fund will decide its allocation to equity and debt. The BAF will rebalance allocations every quarter.

Stock selection will also be rule-based. As liquidity is a criterion that NJ BAF will adhere to, equity investments will mostly consist of large and mid-cap stocks. The other rules for equity investments will be quality, value, momentum and low volatility.

Ravi Kumar TV, founder of Gaining Ground Investment Services, says stock selection is what matters the most in a BAF for it to perform better than others.

He adds that BAF would be an important category in future, if it is able to generate reasonable returns, while protecting against downside. “Investors don’t like volatility, which is what can make BAFs a much larger category if these products meet investor expectations of reduced volatility,” he adds.

The debt portion of NJ BAF will be invested in highly liquid and safe debt securities such as Government Treasury Bills and TREPs.

At current market levels, NJ BAF’s rules suggest 40 percent allocation to equity. For taxation purposes, the scheme will make an additional allocation to equity arbitrage strategies (using equity derivatives) so that the fund gets equity status for taxation and investors are taxed at lower rates.

Source : Moneycontrol